1) trade update. Still long 1 unit of gold futures w/ a stop below current levels. We had taken some stop losses, but over a long weekend, that’s something that must be done.

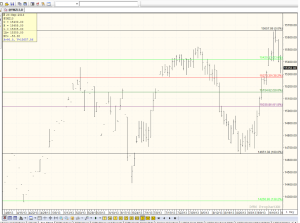

2) Looking at the Stock Indexes, where is a good level to buy? From the low tick at 14,651 on August 28th to the high tick last Thursday at 15,658, that was almost 1,000 pt rally in 16 trading days. What happened since the market had time to digest ? well we fell almost 350 pts from that high to today’s low. 15,273 is a 38% retracement, while 14,150 is the 1/2 way back level…

How to play this? I’d be a seller of rallies with tight buy stops. I’d like to see a flush down to 1534 to 1500. With October almost upon us, with the reverse indicator of the bullish Time magazine article, anything is really possible.

My one issue is this: A lot of folks are still bearish this market. We need the Dr. Dooms of the world to turn bullish. We need someone in the Congress talking about indexing Social Security to the stock market again;

I think more likely, we’ll grind sideways to higher through the end of the year. Post 2013, folks will look at their 401K and realize that in fact, if they didn’t panic and sell in 2009, that they are better off. War weary? Yes, but better off for not having bailed.

Then we need some bullish stories in the media to pump up some interest in investing in stocks again as a means to an end of becoming wealthy.

I just don’t see that level of bullishness yet.

In 2000, I can remember riding the train home every day and listening to a group of guys talking about the “market”. They were a good cross section of people. An engineer, a pipe fitter, a couple of construction workers. They sat in the same car every day. There were also a bunch of floor traders, brokers, clerks, back office people, etc, that owed their living to either the CME or the CBOT.

One thing I remember is the talk that centered around the stock market. Its funny when the pipe fitter, the dry-wall guy, the civil engineer and the floor trader all are bulled up. That was about 4 or 5 months before the top in the nasdaq at 5000.

I just don’t see that level of bullishness right now. Which makes me believe there is room to go higher.

That being said, if you are sitting on 500K or more of mutual funds, I’d be buying cheap puts every quarter as insurance against a 10 or 15 % retracement. A 10% would drop us to 14000. 15% drops us to 13,260. We could drop that much and still be healthy on the bullish side. It would just take some of the froth off, as well as turn popular opinion against stocks again, which, I believe is necessary for the market to get back to climbing the wall of worry.

End idea:? Look for a dip to buy here. Protect the recent 3000 pt rally with some cheap puts and use them to protect your cash position gains.

CER