Looking ahead for next week the biggest feature will be USDA report on Friday the 8th. The big enchilada probably until the always nasty January report.

what to do?

First

1)funds still long beans 2)still short wheat and corn.

2) The long bean play is looking worse and worse. We settled under the 200 day moving average today by 11 cents.

Earlier in the day I had actually bought a small spec position looking for funds to come and defend that price. We got stopped out for just a 3 to 4 cent loss.

At this point, every fund manager out there probably got some sort of sell signal if they are following the long term averages.

1277 in SX That corresponded to 1260 in January beans.

So, we may see some profit taking on those older spreads.. Most likely you’ll see beans break and wheat ( which got lousy exports this week) might finally be ready to turn around now that no one wants to own it.

Most farmers I speak to have already sold all their wheat and are more worried about corn and beans. that tells me the bottom is not in yet for corn and beans. bean bull’s last hope was the funds. If they bail I am not sure who’s going to buy

I did read today about some supposedly massive Chinese buying on going in the Beans. That is probably the last arrow in the quiver of the bulls..

So, I a good contrarian play is to 1) sell rallies in the beans and 2) buy a break out in the wheat.

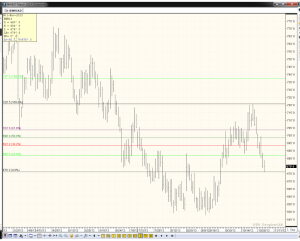

Below is a wheat chart for Chicago March Wheat.