To all the bull’s dismay, 1850 remains a maginot line for the cash S&P. the momemtum players couldn’t run the stops above, and now there are so many earnings coming out, there’s bound to be enough bad news to send people to the sidelines on their longs.

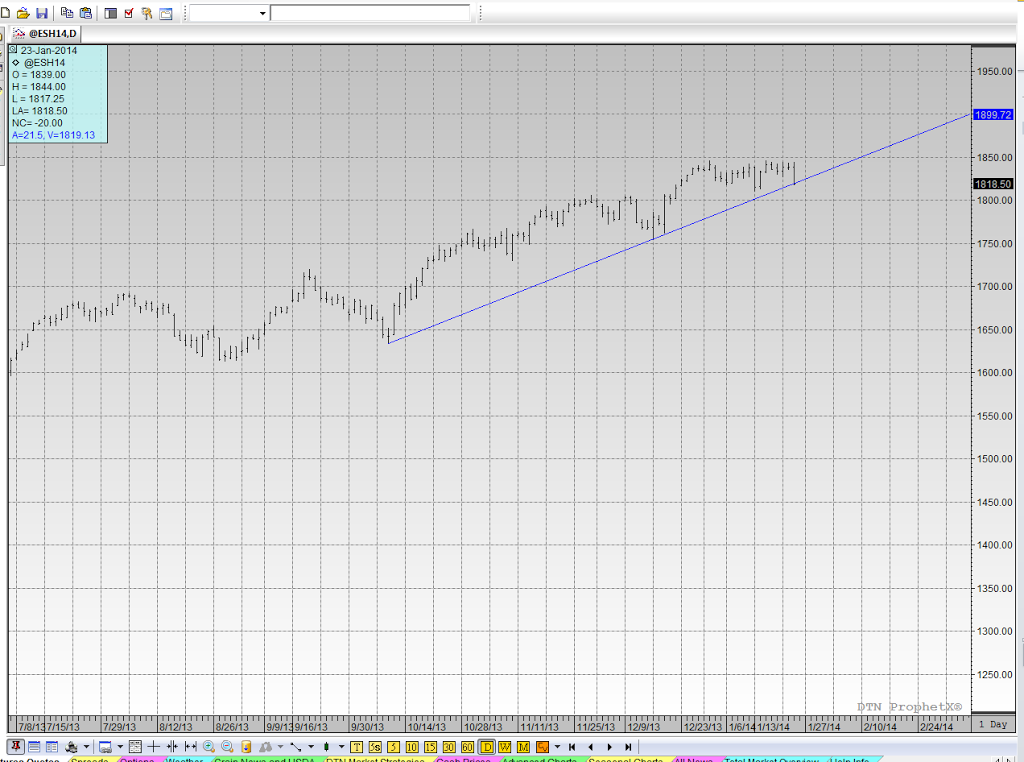

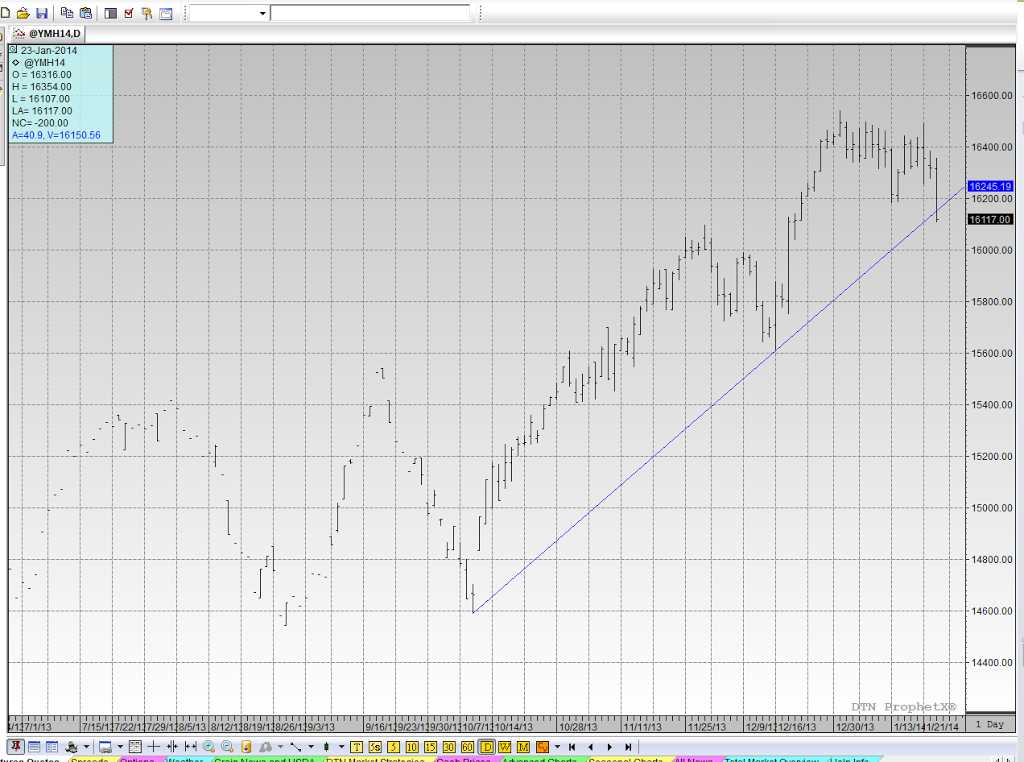

There are two key trend-line in the Dow mini an S&P mini. Look at the charts below.

YMH is trading at 16,118 currently, down 199 pts. 16157 was T-line support. Use this intersection point as a pivot for going long or going short.

ESH is trading at 1817, down 20.75.. It is dancing right at the intersection point which is 18.18

I just had another trader point out that we were below the T-lines. No kidding. Let’s see where we are at 3PM.

On an initial test, I’d buy it here and risk it with a tight stop.

If if fails, then flip and get short and then put in a buy stop. Today is decision day. If they get after it to the downside, Friday,(tomorrow) could be painful for the perma bulls.

That being said, I’d buy it here on the first dip looking to fade the initial sell off.

CER