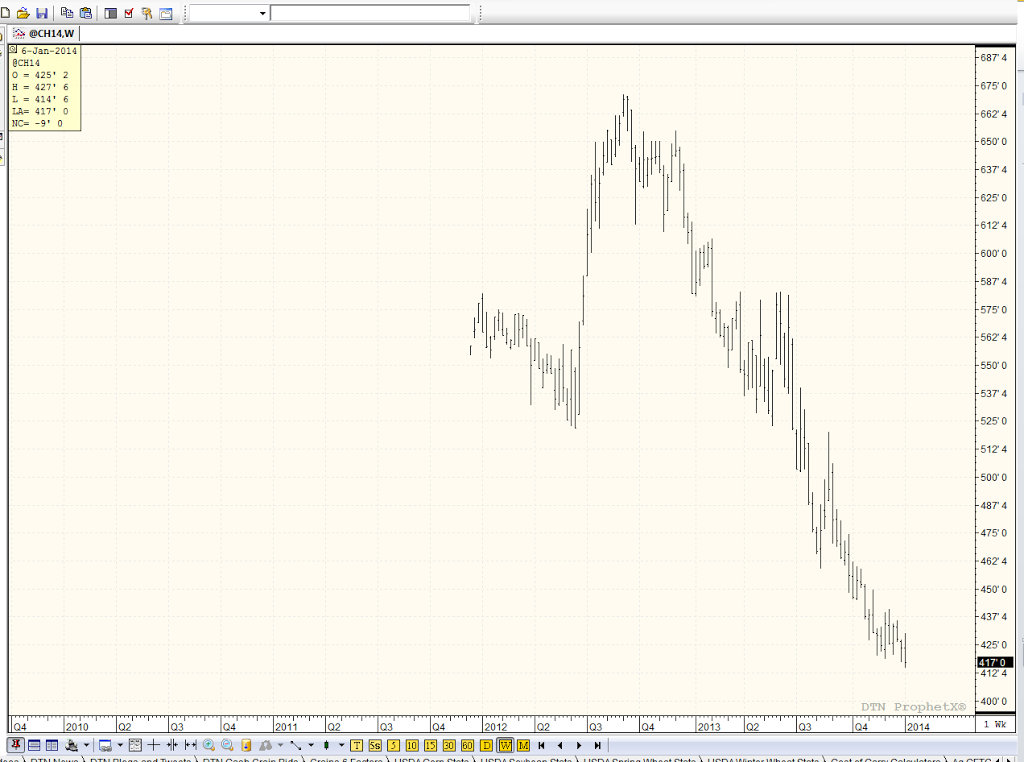

Below is a weekly Chart of “old-crop” corn. CH14. Its an ugly site if you were too bullish in 2013

Now the world has finally gotten bearish. Is the herd really right this time?

Everyone has woken to the fact that we have large crops, 5 to 6 Billion bushels of corn stored and un-priced by the American Farmer, non-threatening weather in S.A (Despite every doom and gloom global warming meteorologist out there)…. We do have temperature extremes. Hottest temps in Australia for Summer; Coldest temp on record here in Chicago a couple of days ago…

I am not sure how taxing us more is going to let the Government “fix” any thing, honestly.

If there is a problem that is systemic its probably going to require technology or another remedy which is not-apparent currently.

Certainly getting China to start cleaning up their environment might be a start. They have lost close to 20% of their arable land due to contamination. Looking at the air pollution in China makes you want to travel there with a haz-mat suit on. The skies in some of their major cities look like Pittsburgh, PA in the 1900’s.

The tree-hugger lefties aught to start with their fellow travelers over in the communist party in China if they really want to do something about “institutional global warming”. Of course, the prospect of ending up in one of their work camps might slow down their zealousness. Its easier to sit in a Starbux with an apple I-pod (ironic) talking about how you would change the world if you were in charge. Actual implementation , at least in America ; always ends up with Uncle Sam collecting more of the citizens money, while they pat them on the back and say “trust me, I’m SO Much Smarter than you!”.. There’s an app for that!! The US Government’s motto– We have a tax for that problem ! Its ironic that in the end, all politicians want to do is look to raise more money.

But I digress. The USDA is going to give us final production for 2013, as well as world wide Supply and Demand.

We seem to be setting up for a buy the rumor-sell the fact action.

The trend is down in grain prices. That’s a given. The average trader/speculator is bearish.

The funds are short 150K corn, 110 K wheat while being long 100K beans. They have been paring down that long position on bean rallies however.

Friday’s report comes out at 11AM. Why couldn’t we rally on a bearish number? Everyone is already short. Look at today’s price action.

There are still 320 days until the next corn crop is in the bin, much less planted. We have a whole summer of weather to get through , We”ll see the Global Warming people at war with those who believe nothing’s wrong. The two extremes will be in cage matches or paintball matches by the end of Summer. That’s the only thing I am sure of. Absent drama from the Dem’s and the Republicans pre-mid term election, the climate issue will probably be the argument du jour. Especially if we have an extremely hot summer or an extremely cold summer. Either way you toss, it up, apparently we are responsible for the weather swings. 🙂

Going into this report, I’d fade the herd with cheap call options especially in the soybeans.

Basis at the gulf remains astoundingly high (30 cents over)…. We have had old crop tightness, which has not been reflected in a sustained manner, at least, with futures. The basis has been doing what the flat board price has not been able to accomplish.

If you want a specific rec; become a client. It only takes about a day to open an account with me and get some trades in place.

Small bets against the herd could pay off smartly between Friday 11AM and Friday 1:15 pm. Ditto for corn and wheat. The boat is leaning awfully hard towards the bears. In the long run, they are probably right (correct) However, I’d wouldn’t be surprised to see a snap back higher even in the face of bearish news from the USDA.

CER