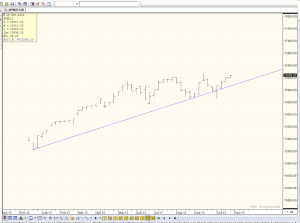

Below is a weekly chart of the Dow December Contract. As you can see there is a good long term bull t-line going back to Dec of 2012. In September, we hugged it pretty well around the 14,700 and again in the last week of September, when 14,918 held. This set us up for a nasty head fake. The week after it tested that line and held, we fell all the way down to 14650 on the government shut down freak-out., only to rebound and settle at 15,175. Just a 500 point swing to squeeze out the weak longs who had been looking at this Trend line as support.

This is s perfect example of why T-lines, even long term T-lines can fail us. The fact that they fail sometimes is enough for some to completely dis count their use. Interestingly, the T-line held again the following week. So… what’s the point you are probably saying about now…

The fact that we are within 46 points of the September 16th contract high with today’s high at 15,612 gives us an opportunity to put on a good risk /reward trade.

Sell the Dow Dec at the 15,650 level. Hope for a 15,700 tick to sell. Risk 100 pts. Look for a sell off back down to the T-line around 15,200 for a cover. If however, you get stopped out then so be it. Its 100 pt risk to make 400 pt profit. You could even make it a 50 pt risk to make 400.

Its totally a play on this weekly T-line. Conversely, buy a 1500 put for $1000 bucks for the next 52 days. You are 600 pts under the market, but the most you can lose is the $1,000. That’s on a 10.00 DJIA contract. On a mini its, $500.00.

We’ll see how it turns out, but I like this trade. Selling into new highs looking for a pull back to that T-line.

CER