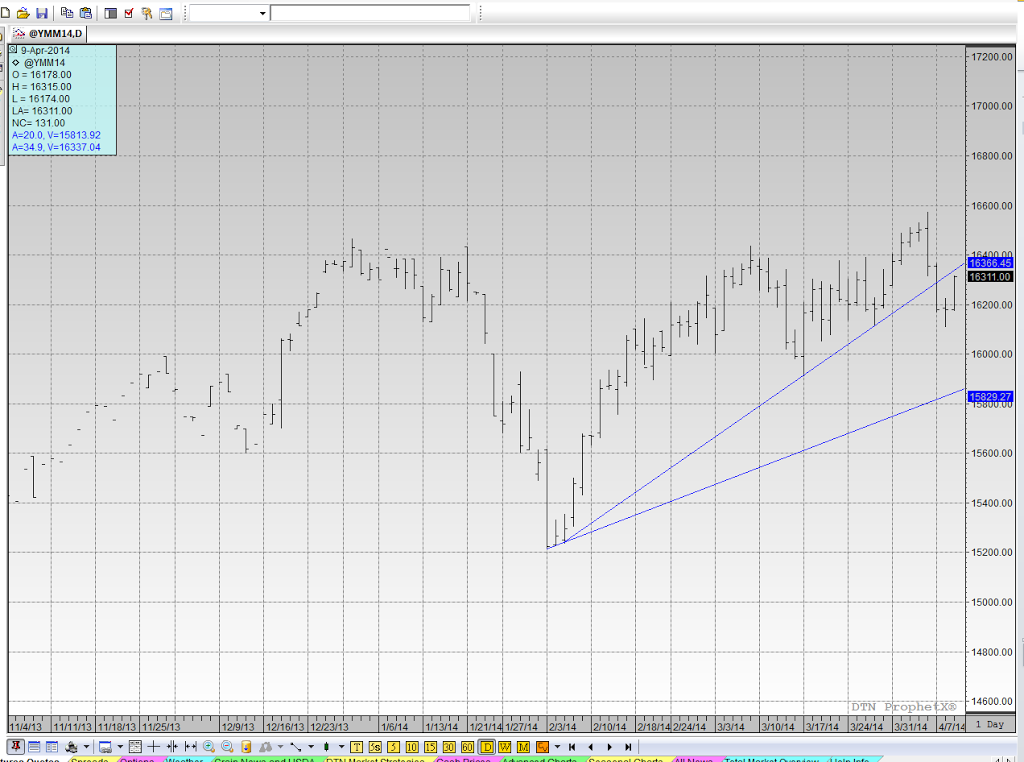

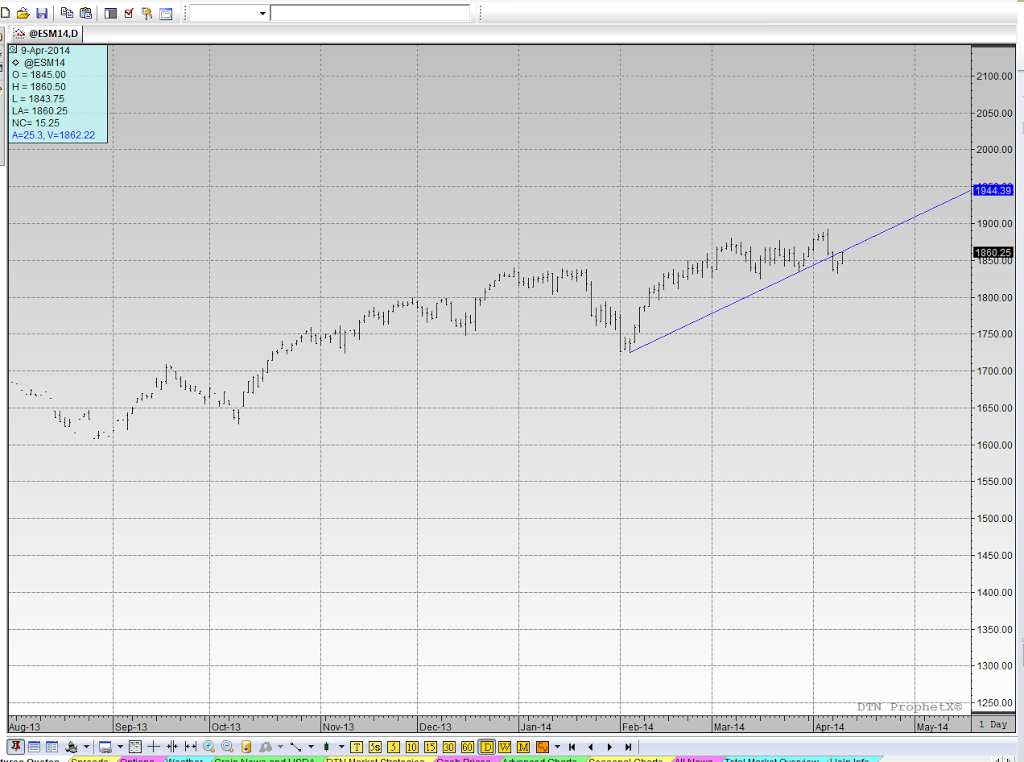

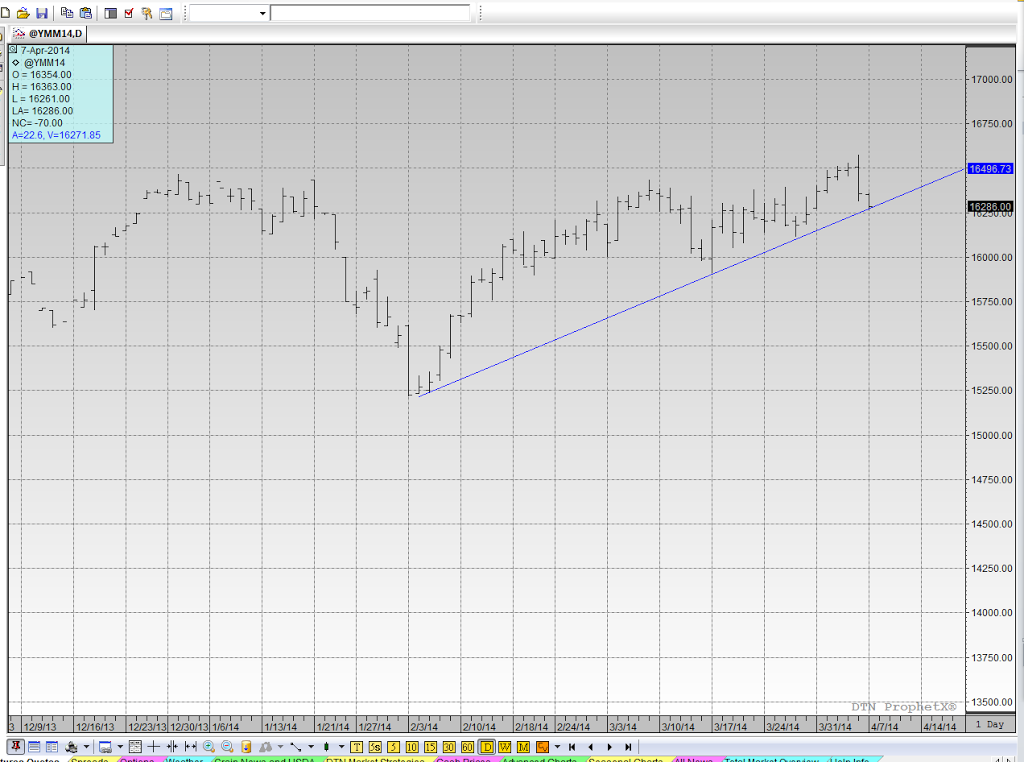

Stock indexes holding in there after a weekend of non-action and more lead flying in the Ukraine.

Obviously, the market has made the rational decision that the likely hood of NATO or the US EVER putting boots on the ground in Ukraine is about as likely as Richard Nixon running for President in 2016.

What is interesting is the failure of the trend-line in Gold.

And , finally the failure of the wheat market to hold its “risk premium” that had built up over the last few weeks on Ukraine worries.

Apparently, the Easter Bunny left the hard data in trader’s baskets yesterday, reflecting the […]