First off, yes; when CU/CZ rallied above 40, I took off 2/3 of the position. I really thought we could have a bounce to 50: If you’ve been following, you know I suggested this spread since first week in June. Roughly a month ago.

For the 1/3 I still have on, I am not sure how low it could go. Best case would be from 28 over til 8 under. That would be 36 cents more profit from here. If you are putting this bear spread on now, make sure you have 36/37 as a run and hid stop level. Risk 10 cents to try […]

Blog Archive

CZ Searching for a Bottom: Hold your short positions, take profits or roll down protective buy stops

Brazil sends us beans. This sends Old Crop beans to the wood shed- limit down

Brazil sends us beans. This sends Old Crop beans to the wood shed- limit down. August beans traded as low at 13.92 1/2. I covered my last short at 14.25. We are currently trading 14.10 For now, I am sitting tight. Let the smoke clear before you start trying to catch rallies or establish any new shorts.

I think cash grain traders who know this grain was coming cleaned up. Absolutely. The delivery of the beans from South America to St. Lewis. 10 Cargoes. Bye Bye old crop beans.

The Sale at 15.10 looks better and better. Who Knew? Sometimes s technical trade gets a […]

Position Update on Corn and Bean Shorts

On July 9th, I suggested selling that rally in CZ up to 5.30 and I had resting orders to sell August Beans at 15.10 if it ever popped up there.

If you have been following along, we actually have been short since the 5.65-5.70 level in CZ. We took heat, got stopped out on a weekly basis. Fortunately, we re loaded on the way down.

Today CZ is at 4.83

I have 4.70 to 4.60 as the next level.

Today August beans are at 14.84. 15.25 was the high in August. Cover shorts at 14.51 and 14.36.

Take profits or roll down buy stop locking […]

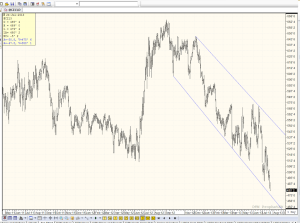

Gold Upside Target 1420 or 1491

August Gold on the weekly chart has retraced 25% of its 9-month, $625 dollar sell off as of today’s bounce. Gold saw a 35% decline in value over this down move. I am not sure if this is anything more than a technical rally. Some are blaming this on Bernanke’s comments. I think its more like a lot of folks got short gold below 1300, had a $120 winner on the books, and are now heading for the exit before heading on vacation.

August is almost upon us. That’s when most of Europe goes on vacation and a lot of US money mangers slow down […]

If December Corn CZ settles below 4.90, we have another leg lower

Rain was less than desired in Iowa, but about 40% of the WCB and ECB got 1/2 inch to an inch.

Its a mixed bag, but we are on our lows.

Funds lightened their short position as of last Friday in both corn and wheat. I like owning corn puts and owning wheat calls, looking for that spread to pop higher for at least 30 to 40 cents.

Today we trade weather again in the corn. Looking at AG web posts, it looks like if you post anything bearish about corn, you’ll be on a hit list. Group think has a poor track record […]

Sep Dow Is Still A Sale in My Opinion

Barring 2 consecutive settlements above 15,500 in Sep Dow Futures, I’d remain short.

The cash Dow posted a record high yesterday, on the 18th at 15,589.

If you have followed me for any length of time, you know I like to fade popular opinion. I have to think this weekend all of the Talking Heads across the media blitz field, will be talking about the new record highs in the Dow.

Will any one notice that we have rallied 9000 pts from the 2009 lows? This morning when I drove to work, I listened to the same add 3 times on AM radio. The company […]

Hedge Advice for Farmers

Buy Wheat/ Sell Corn for a seasonal Speculative Trade

Dow Short and Bean Short

1) Make sure you have buy stops controlling risk on the Sep Dow short position if you have futures in place.

2) Make sure you have buy stops in the August bean position if you have futures in place.

If you want to remain bearish, but limit your risk, look a the following puts:.

Buy an August 1300 put for 24 cents. That’s $1200 bucks with unlimited profit potential.

In the Dow, consider at 1500 put for 153.

We’ll watch how these options play out over the next 2 months.

Regards,

CER