Well, one word for today’s action. Bullish.

KWZ turned its nose up at the 675 target I wrote about yesterday, and instead blew to a new 12 month high at 695 1/2. I find it interesting that we couldn’t go for the likely stops above 7.00. Maybe Sunday Night?

All in all impressive, but remember the adage that markets climb up the stairs, only to fall down an elevator shaft when the buyers are exhausted.

This has been the largest single monthly percentage gain in wheat since 1973. Stepping in to try to pick a top in a market like this is similar to […]

Blog Archive

How high is Too High for the Wheat?

In June of 2009, Kansas City December Wheat posted a high at 7.92 3/4. 12 months and 3.08 lower, we posted our recent harvest low at 4.85. We just recently blew through the 50% retracement, at the 6.40 level. If you’ve been reading my blog, you know I like to trade with the 50% level as a target to initiate trades, both long and short.

Technically, if we settle higher here tomorrow, the last trading day of the month, and the last day of the week, we could be […]

Crude Oil Technical Head Fake

On the Fourth trading day after what looks to be a definitive bullish break out, we have the head fake. The market breaks sharply, settling below the upper trend line of the symmetrical triangle formation.

This is precisely the type of price action that goes along with technical analysis. Just as traders might have finally joined the bullish camp, looking for solid follow through to the upside, the market corrects. I would argue that after watching these markets for 22 years, moves such as this are common.

Which is […]

Three Charts Bearing Gifts

First off, the ZC Corn. This chart shows that we have seen a 50 percent correction of the 66 cent rally. Today’s low took out the 50% retracement at 376 5/8. Next support is at 368 3/4. Take advantage of this down move to cover shorts. Depending on how much of a turn-around-Tuesday bounce we get, it […]

Link to My CME and Bloomberg comments from Friday Morning

http://cmegroup.mediaroom.com/index.php?s=64&bcpid=74064322001&bclid=68364394001&bctid=221083236001

Crude Oil Moves Towards Major Technical levels

The above chart was a daily chart for August. August expired this week. Unfortunately, I am away for the weekend and can not access my charting software. On Monday, I will up load a chart covering the new spot month, CLQ, August.

Be that as it may, this symmetrical triangle formation is a powerful indicator. Again, I tend to lean toward the simplest, purest chart formations when looking for moves to either go with or to fade. This chart gives a graphic representation of how a trend-line acts […]

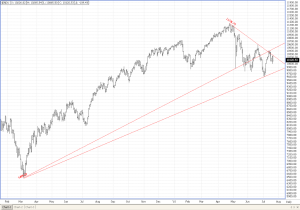

Dow Cash Approaches Key Intersection of Trend Lines

First off, if you don’t understand trendlines, go read some basic technical analysis. This entry focuses on the importance of long-term tend lines.

The two snapshots of the Dow serve as key illustrations as to the self-fulfilling nature of trend lines.

Chartists and non-chartists look at trend lines. Period. Analysts who profess to be purely fundamental, if you gave them sodium pentathol, would admit to looking at long-term trend lines.

Far […]

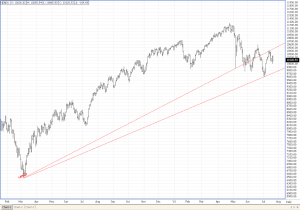

Dow, S&P, and Crude at Critical Chart points

Taking a look at some charts late tonight. The Dow Jones Cash looks like its poised to take a Summer Dump down to the 9600 level. Basic Technical analysis confirms that the intermediate (3 to 6 months) trend is lower. We have had lower major lows and lower major highs for the past 3 months. Its funny […]

Dow, S&P, and Crude at Critical Chart points

Taking a look at some charts late tonight. The Dow Jones Cash looks like its poised to take a Summer Dump down to the 9600 level. Basic Technical analysis confirms that the intermediate (3 to 6 months) trend is lower. We have had lower major lows and lower major highs for the past 3 months. Its funny […]

Spec Funds are long… are they wrong?

Commitment of trader’s report today showed funds are long 193K contracts of corn. Today’s trade watched profit taking as the weather forecast took out the premium. New crop corn (CZ) snapped to a low print of 389 1/4, 20 3/4 cents from last Tuesday’s 4 month high CZ at 410. Support lies at 384 1/2, 376 1/2 and then 368 1/2. Any one of these should be a good entry point for a trade, looking for a 5 to 10 cent bounce off of those levels. Will new crop challenge the 415 March highs? It depends on the weather forecast and the steadfastness of the […]