I like being long SN, especially on a 20 cent break from 940 to the old resistance level at 920. 950 and 975 are good targets to sell into on the first bounce up there. As July gets ready to expire, we should see a lot of significant price development, with less static noise and choppy trade. Old crop beans should be bought on dips. However, you need to have stop limits beneath every buy order. If I am right, and we get another 75 to 150 cent rally, just move up your trailing stops. Beans are made in August. Its the middle of July. […]

Chris Robinson

USDA Tomorrow, CNBC once again a Fade

First off, too bad no one actually reads this thing. I wrote just last night that it looked like old crop beans SN would go test 1020. We did just that, traded there and then broke hard right after. Resting order to sell there worked well, especially if you bought the dips on the way up. However, currently my readership is about negative 3, so it doesn’t really help anyone but me.

Tomorrow we have USDA out.. It will most likely be bullish in tone. However, I am anticipating a spike higher and then a correction lower on a “buy the rumor-sell the fact” trade.

If it Looks like a weather market, it acts like a weather market….

If it looks, like it, acts like and smells like it, we could be looking at the break out from our 4 month sideways chop in the grains. CZ pushed up against the 390 level, SX is up against 934,and old crop looks like its coiled and ready to test 1020 and then 1075.

Wednesday’s supply and demand could give us the fuel to finally break up and out of the resistance which has characterized these grains for the last 4 months. The oats, otherwise known as the canary in the coal mine, seem to have taken a break after a violent move higher, followed […]

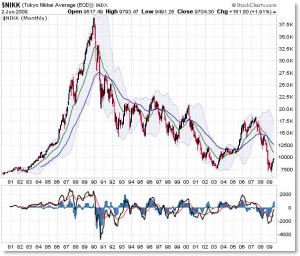

What Has The Dow Really Done over 110 years?

To better demonstrate the true magnitude of the great bull and bear markets of the last century, it is necessary to adjust the Dow Jones Industrial Average for inflation. What the CPI (Consumer Price Index) adjusted Dow chart shows is that the 1966 to 1982 bear market was almost as severe as that of the early 1930s. And since 1982, a true and great bull market has ensued (even when adjusted for inflation).

I did some quick research this morning, July 5th. This is food for thought for […]

An Important 4th of July for US to Stop, Look, and Listen

A broker friend of mine made a great comment just the other day. He said this market won’t bottom out until they have taken every bull in the room outside and shot him. At that point the bottom will truly be in. This individual was very pessimistic on the market’s current slide, however, I think his statement is very accurate. We really can’t have a bottom until the bulls have left the building on a stretcher…

Like Apollo Creed at the end of Rocky 1… “Aint gonna be no […]

9753 and the “experts” are panicking

Apparently, every TV commentator has finally taken a basic technical analysis course. They all know how to read a chart, or at least recent lows and highs. Congratulations, we’re making progress.

However, having an intra day trade at 9853 and a settlement at 9775 constitutes a “failure of 9800”.. Good lord, they are picky. My guess is that they and everyone like them who sold against the 9800 number today is going to get hammered by a short covering rally tomorrow through Friday.

We are going into a long weekend. If you were short, are you going home short over a holiday weekend where any […]

9753 and the "experts" are panicking

Apparently, every TV commentator has finally taken a basic technical analysis course. They all know how to read a chart, or at least recent lows and highs. Congratulations, we’re making progress.

However, having an intra day trade at 9853 and a settlement at 9775 constitutes a “failure of 9800”.. Good lord, they are picky. My guess is that they and everyone like them who sold against the 9800 number today is going to get hammered by a short covering rally tomorrow through Friday.

We are going into a long weekend. If you were short, are you going home short over a holiday weekend where any […]

Limit Bid in the Corn…. We lost 1Million Acres

Looks like my idea that farmers were capitulating was correct. The USDA came out extremely bullish here today for corn. Expecting 88 to 90 million acres, instead, we got 87.8. We lost one million acres of corn. Opened higher today, and has danced around limit bid (+30) cents all day. This is looking like a sea change. We moved all the way back to our 2007 lows in the Dec 2010 contract. Made a new contract low,

frightened producers into what are shaping up to be sales in the proverbial hole.

Rest assured, its a good time to re-own sold bushels. A 15 cent investment […]

China Syndrome

Well, the market has been searching for something to wring its hands about. Today we seized on European banks, and the sudden realization that China’s economy is big enough to give us pause.

Its the end of the quarter, end of the month.. a lot of money managers are heading off to the Hamptons, Aspen, or where ever the beautiful people go these days. Europe is moving into the Summer diaspora of vacations. All of this, combined with a spook from China, was enough for the bulls to take […]

Where are the Funds?

This is shaping up to be a whether market, not a weather market. Are we seriously going to have a drought this year? With fields in MO and the Dakota’s looking more like Rice Patties in Viet Nam, are we really still looking at a drought? Or will the dryness in the south eastern states prevail? This uncertainty has us in a sideways chop. The large speculative commodity funds are still short 45K Chicago Wheat, Long 30K corn and long about 20K beans. Hardly anything to write home about. Once again, I think its the computer programs, squeezing the life force out of these markets. […]