Quick 347PM update. 7 1/2 percent pull back in the Dec S&P on the low at 1864. We are back to the May lows. 150 handles from the record high last month at 2014. 10% takes us to 1813. FYI 6% pullback for the Dow futures.Today’s low? 16221 which is 1,058 points removed from its record high 4 weeks ago. 15,551 is a 10% correction. The August low was 16143. We’ll see how the market trades to night. 10% is looking more and more like its in the cards. QE is ending. There seems to be a collective worry now that we are about to […]

Chris Robinson

7-1/2 % Correction for S&P/ 6% for the Dow

Quick 347PM update. 7 1/2 percent pull back in the Dec S&P on the low at 1864. We are back to the May lows. 150 handles from the record high last month at 2014. 10% takes us to 1813. FYI 6% pullback for the Dow futures.Today’s low? 16221 which is 1,058 points removed from its record high 4 weeks ago. 15,551 is a 10% correction. The August low was 16143. We’ll see how the market trades to night. 10% is looking more and more like its in the cards. QE is ending. There seems to be a collective worry now that we are about to […]

Dow Sell off totals 945 points or 5 1/2 %; S&P corrects 6.6% from the Sept Record Highs with a 134 point swoon

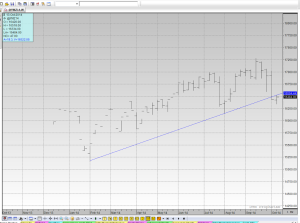

For the Dow, we have a 5 1/2 percent correction from the record high posted one month ago at 17,279. Note the 8-month trend line again I have highlighted. That intersection point today is 16564. That level offers a decision point for both bears and bulls. Is there another 4 1/2 percent to the down side? If you think so, the only way to play it is to sell rallies, or buy the 15,500 puts. The S&P futures took out the August low by 2 points, and then buonced. That […]

Dow Sell off totals 945 points or 5 1/2 %; S&P corrects 6.6% from the Sept Record Highs with a 134 point swoon

For the Dow, we have a 5 1/2 percent correction from the record high posted one month ago at 17,279. Note the 8-month trend line again I have highlighted. That intersection point today is 16564. That level offers a decision point for both bears and bulls. Is there another 4 1/2 percent to the down side? If you think so, the only way to play it is to sell rallies, or buy the 15,500 puts. The S&P futures took out the August low by 2 points, and then buonced. That […]

Stock Indexes Give it all back in volatile markets

Volatile markets generally are signs of tops. Swinging 3 to 4% a day is difficult to catch, and can lead to a lot of whipsawing ans second guessing. If you are day trading the S&P or Dow, you must lower your bet size and raise your stops. The S&P has support at 1918 and the Dow has support at 15,582. Buy it against those pivots, but be ready run fast if it rolls over. As for the Grains: I’d be a seller of rallies in front of the USDA tomorrow at 11.00. Some week one options are the cheapest way to play the market either […]

Pre-USDA Grain Wrap-Up

Does a 4% correction from the recent high justify calling the Suicide Hotline?

The newest sport seems to be bear hunting the stock indexes. The S&P Futures already blew through the 62% retracement and then some last week. today’s low at 1918 gives us a double bottom there. since its only 10:17 its anyone’s guess if that holds. If it fails the next support on the charts is 1915, then 19.00 Moving over the the Dow. Today we got the 62% RT of the 1100 point rally which began in August. for now its a 4% correction off the highs in the Dow and approaching a 5% correction. Sentiment seems bound and determined to lean on this market. […]

Dow sell off looks to challenge last Thursday’s low at 16589

This is the most volatility I’ve seen in the Stock Index futures for a long while. And I know of what I speak. Back in the late 1990’s we had regular 200 to 300 point trading ranges in the day session. We would explore that trading range sometimes 2 or 3 times in a day. To see a few sessions now of 200 plus trading ranges, we may be moving, finally into a topping cycle in the Dow. I emphasize MAY. We got our triple in the S&P, but not quite a triple in the Dow. That target remains 19500. But maybe 17,280 is as […]

Dow sell off looks to challenge last Thursday's low at 16589

This is the most volatility I’ve seen in the Stock Index futures for a long while. And I know of what I speak. Back in the late 1990’s we had regular 200 to 300 point trading ranges in the day session. We would explore that trading range sometimes 2 or 3 times in a day. To see a few sessions now of 200 plus trading ranges, we may be moving, finally into a topping cycle in the Dow. I emphasize MAY. We got our triple in the S&P, but not quite a triple in the Dow. That target remains 19500. But maybe 17,280 is as […]