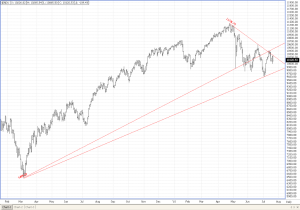

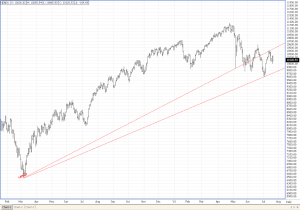

In June of 2009, Kansas City December Wheat posted a high at 7.92 3/4. 12 months and 3.08 lower, we posted our recent harvest low at 4.85. We just recently blew through the 50% retracement, at the 6.40 level. If you’ve been reading my blog, you know I like to trade with the 50% level as a target to initiate trades, both long and short.

Technically, if we settle higher here tomorrow, the last trading day of the month, and the last day of the week, we could be […]