Gold based between the late 90’s and until 2003 at around $300 bucks an ounce. it spiked to its high of 1950 during the fear trade run up of the 2012 election. That August, 3 months before the 2012 election, the gold bugs had their day in the sun. Today, we are testing 4 year lows at 1169. Simple math gives us 1125 as the half way back point of this historic rally. Below I’m posting two charts. A picture is worth 1,000 words. First is a weekly chart of the Dec 2014 futures contract.

Logistic Issues – Traders Exclusive – Chris Robinson talks about the grains rallying. The number one thing driving this rally is the grains cannot get to the crushers because of a rail car shortage.

Dow Moves towards Technical Resistance at 16,700; Panic shorts have been run out for 1000 point loser

Delayed Harvest and Expiration – Traders Exclusive – Chris Robinson talks about the grains, expiration, and the cattle market. One key thing to know about the grains is that the harvest has been delayed.

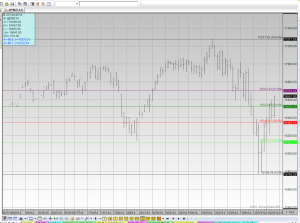

The S&P takes back more than half of the 10% correction

The S&P takes back more than half of the 10% correction

27 Years after the 1987 Crash

27 Years ago today we had the 87 crash. The Dow Dropped 507 points in one day..22 percent. To contrast; if we had that same 22 % drop today, the Dow would drop 3586 points and we’d be at 12,714. FYI 🙂

Hindsight is 20/20: 1500 points in the Dow and 201 Handles in the S&P

I felt yesterday we’d get the last 200 points in the Dow futures we needed to get that 10%. I was wrong. A couple time we sold the market and then were stopped out for losses on rallies. In this environment, I believe options are better risk reward than the futures, because of the volatility created by hft programs. It seems no matter where you put you stops trading futures, the worm programs will finds you . 2 ticks or 102 ticks, they will seek you out. The options allow you to take a position and not get stopped out. Moving forward, I have made […]

Hindsight is 20/20: 1500 points in the Dow and 201 Handles in the S&P

I felt yesterday we’d get the last 200 points in the Dow futures we needed to get that 10%. I was wrong. A couple time we sold the market and then were stopped out for losses on rallies. In this environment, I believe options are better risk reward than the futures, because of the volatility created by hft programs. It seems no matter where you put you stops trading futures, the worm programs will finds you . 2 ticks or 102 ticks, they will seek you out. The options allow you to take a position and not get stopped out. Moving forward, I have made […]

Don’t Fight The Fed

The Fed’s James Bullard suggested that the QE might start up , or never officially end as its supposed to at the end of this Month. Of course, many had anticipated a fed rate hike in March. That has all been shelved, with 1) the slow down in Europe 2) the German’s reluctance to ease 3) China apparently slowing down 4) The drop in oil prices, suggesting a world wide slow down and finally 5) Ebola. If Ebola gets into the heads of the US public and they decide to stay home and stop shopping, then we have a slow down because the consumer is […]