Sep Crude oil, depite Mr. Putin, is poised to test 91.00 on the weekly charts.

interesting the knee jerk reaction, once again saw stocks break (then rally back) and the grains rallied. Truly knee jerk rally in the wheat here in the US. Although short lived. Anything can change over the weekend, but despite these shocks, the supply and demand is pointing towards lower gold and stronger stocks.

Note the weekly chart below in crude oil. Note the resistance at $106.60 for Sep Crude. If we ever trade above that, you would expect a break out higher. Vise versa, if we settle below […]

Uncategorized

CZ approaching a T-line resistance at 3.84 3/4

There is a good T-line here in CZ. CZ is most likely over sold, and a lot of analysts have noticed the reversal on Monday/Tuesday. If we get a weekly reversal, that also will be bandied about b/c corn has not had a bullish story since July came and went with out a dome of death with heat/dryness. My guess is the funds might use this to lighten up on their long corn/short wheat spread.

The gap at 3.78 was filled last night. The next gap above is at […]

Dow Claws back 1/2 of its recent 5% sell off!

Grains Digest USDA; Look for the Weekend Weather

Written by Chris Robinson

Corn: September corn settled down ½ cent at $3.58. New crop CZ settled up ¾ at $3.69 ¾. Corn posted its early this morning during the electronic session, trended lower for the first hour of pit trade and then rebounded through the afternoon in rather uneventful price action, moving through just a 7 cent trading range. Funds sold 2000 contracts after starting the day with an estimated long position of 74,000 contracts. Technically, […]

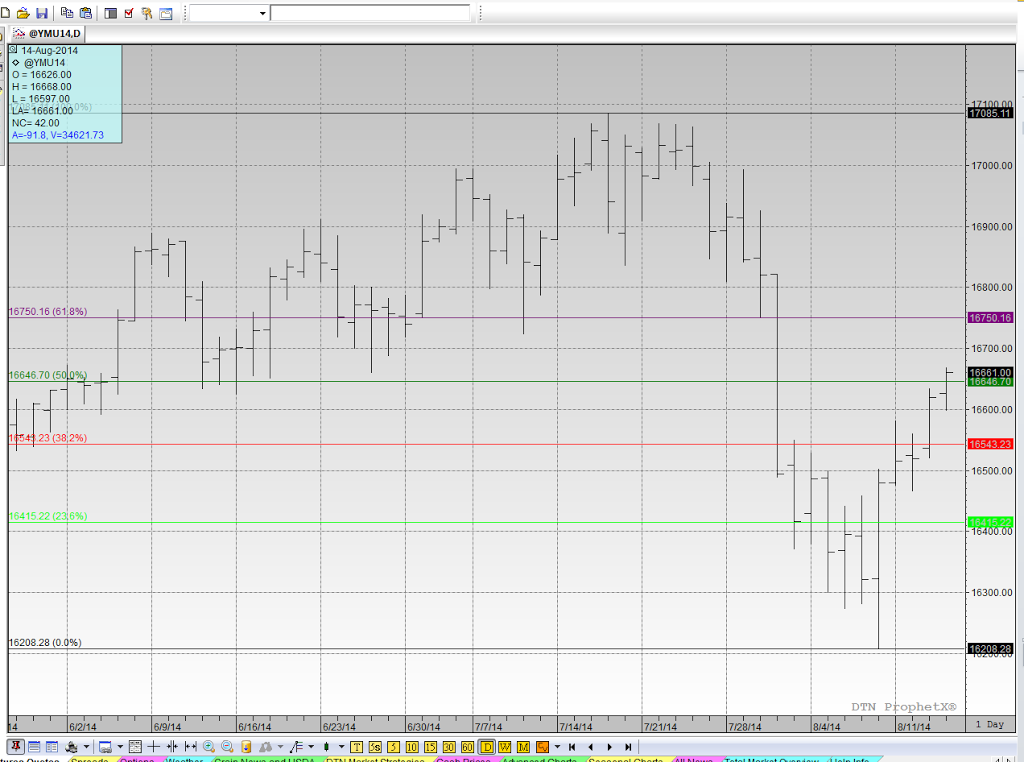

Stock Indexes Bounce off of technical support

Above is chart of Dow Futures September. This is a weekly chart. This is a trend line. We tested it last Thursday night by 40 ticks, then rallied like a little bottle rocket. I never understand “traders’ who totally discount technical indicators. We’ll re-visit this trend line again, most likely in September or the Ides of October, in my opinion.

For now , the break down looks like this from my notes:

High: 17085

Low:16208

Difference: 877 pts. (please note that the 877 points was only a 5.1% […]

For Grain Hedgers USDA on the Horizon

Corn: September Corn settled down 7 ¾ cents at $3.63 ½. Corn posted its high in the overnight trade, opened lower and then grinded lower through the rest of the day. For the week, September Corn lost ¾ of one cent while December Corn gained 1 ¼ cent and settled at $3.63 ½. Corn gave back all of the rally we saw Monday and Tuesday as traders took profits and focused on next Tuesday’s USDA crop production and supply/demand report. Funds sold 8,000 contracts today. The 10-14 day […]

Stock Indexes ping 5% correction overnight!

The Dow futures posted a low last night at 16208. 16231 was the 5% target I penciled out a few days ago. Just basic percentage math, nothing special.

The S&P futures posted a low at 1890. The perfect 5% correction would have been 1885 according to my math.

Now that we’ve had that tipping point, we well most likely get a relief rally.

Of course, the decision point is is there another 5% down? That’s anyone’s guess.

Its August. Its Summer. Market are thin. Trade accordingly

10% takes us to 15377 in the Dow and 1787 in the S&P. All Sep Futures.

Its […]

16, 231 Dow Futures? or 15,377? Gut Check Time

We had our bounce back to 16,500 and couldn’t cut through.

Today’s low is 16272 and we are trading at 16,312 currently as I type this.

16231 again is important b/c its 5% pullback from the high at 17085.

For those of you who are true “doom and gloom, sky is falling, better get in the bunker and load up on shot-gun shells and canned goods” a 10% pullback gets us at 15,377. I’d call it 15,400 just to be simple. Of course if that happens, we’ll probably get the 15,000 print, just to paint the tape.

A correction here is a gut test […]

Yields and the USDA – Traders Exclusive – Chris Robinson talks about the upcoming USDA report and possible outcomes.

Friday, Dow posts a 4.2% correction, while the S&P posted a 3.7% correction from the recent high

The contract high for Dow Sep Futures was 17,085. Friday’s low was 16370. That low took out the May 22nd low by 60 ticks.

A 715 point break from the high to Friday’s low pencils out to a 4.2 % pull back. If you read my last few entries, I wanted to be a buyer at a 5% break. That would have been an 854 point break, or 16231.

For Sep S&P futures, the high was 1985. A 5% correction would take us down 99.25 handles. A 10% would take us down 198.5.

Friday’s low was 75 handles off the high, or […]