Unlike 2013, the USDA threw no big surprises at the markets today. Acres were within estimates, a little higher for beans and a little lower for corn, which spurred CZ-SX spreading . July/Nov old crop new crop went from its pivot at 2.00 out to 2.46. It seems determined to push out towards 3.00 over time.

Funds are long 180 beans, 250 corn and 50 wheat , and are in the driver seat.

I personally had thought there was a 70 percent chance of a down side flush on bearish USDA, but carry out for corn dropped to 7.000 billion and stayed at 998 or […]

Uncategorized

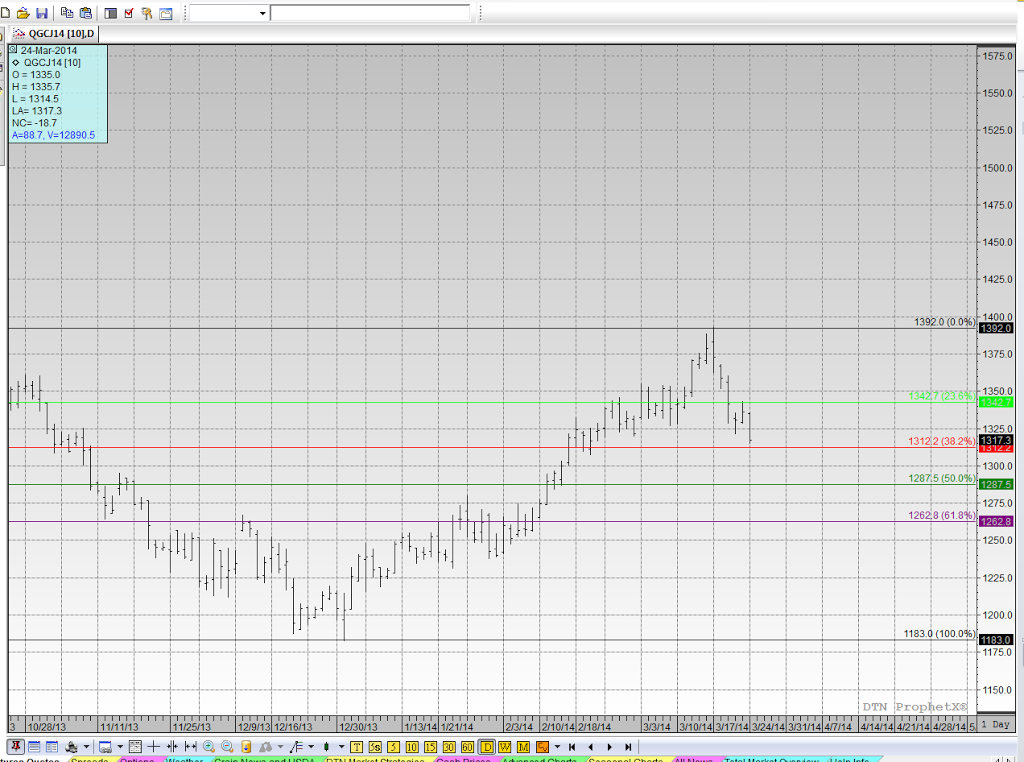

Gold retraces 38% of its 3 month $209.00 rally

April Gold Retraces38% of its 3 month rally. Last week, April gold rallied to its highest price since September. That’s marked a 6-month high. That was a week ago today. The high tick was 1392.60. We missed the 1400 print by just $7.40

First support it 1312

Second support 1287

Third support 1262.

These are pretty simple Fibonacci Supports.

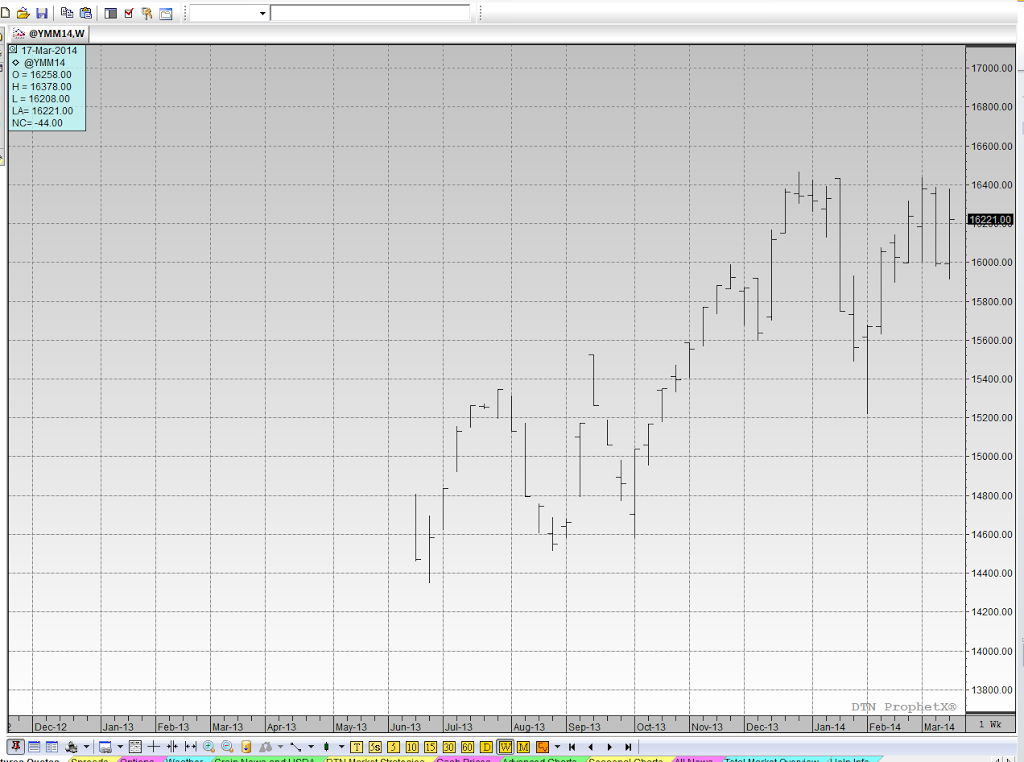

Topping out in the S&P and the Dow?

This is a Weekly Chart of the Dow basis June contract.

6 weeks in the past 13 we’ve tested 16400 and sold off. In my opinon, if we settle above 16,400, it opens the door to a run up to at least 17,000.

IN the mean time. Every time it comes close to 16,400 : I’d continue to sell it.

If you had done that in the past 3 months, you would have had a bunch of opportunities to scalp profits on the sell offs.

Is there a […]

Topping out in the S&P and the Dow?

This is a Weekly Chart of the Dow basis June contract.

6 weeks in the past 13 we’ve tested 16400 and sold off. In my opinon, if we settle above 16,400, it opens the door to a run up to at least 17,000.

IN the mean time. Every time it comes close to 16,400 : I’d continue to sell it.

If you had done that in the past 3 months, you would have had a bunch of opportunities to scalp profits on the sell offs.

Is there a […]

Hedgers: USDA closing In after a volatile week in the grains

Corn: May Corn settled up ½ cent at $4.79. December settled down 1 ¼ cent at $4.79 ¼.. For the week, CK settled down 7 cents, while CZ settled down 7 ¼ cents. Corn had subdued trade to finish the week, with just a 5 cent trading range. It looked like the trade was more interested in their NCAA brackets then making big changes heading into the weekend. May corn has done some back filling in the wake of the 6-month high at $5.02 ½ posted two weeks ago. […]

Get your hedges on in front of the USDA on the 31st

Corn: May corn settled up 1 cent at $4.86. December settled up 3 ¼ at $4.87 ¼. For the week, May lost 3 cents while December gained 2 ½ cents. The trade was lighter than usual, and a typical for a Friday on a Holiday-type weekend. Last Friday’s high print at $5.02 ½ punctuated a 2-month, 88 cent rally which saw May gain 20% in value from its January 10th 3-1/2 year low. The market seemed to take a breather here after that high tick. Most of the […]

Dow VS S&P Resistance

March Dow Futures Above : Challenging its Contract high. What’s interesting ? The more narrow Dow index of 30 stocks has not been able to take out the High posted 12/31/13. 16540. Friday’s high tick was 16508. Is this a top? I think if we settle above this level, it opens up the door to 17,000 as a nice round number target. Money flow has continued to support stocks, even in the face of Geop political issues in the Ukraine. The market has gotten bad news from there […]

Dow VS S&P Resistance

March Dow Futures Above : Challenging its Contract high. What’s interesting ? The more narrow Dow index of 30 stocks has not been able to take out the High posted 12/31/13. 16540. Friday’s high tick was 16508. Is this a top? I think if we settle above this level, it opens up the door to 17,000 as a nice round number target. Money flow has continued to support stocks, even in the face of Geop political issues in the Ukraine. The market has gotten bad news from there […]

WASDE at 11 AM

We get grain numbers out today. We’ve had a grinding 2 dollar rally in old crop beans, 1 dollar rally in old crop corn and wheat.. Open interest has dropped on this rally, meaning its been shorts covering and exiting the open interest. A market rallying on declining open interest is not a sign of an underlying market trend that has legs. Instead, it is more of a relief rally as traders with loser’s on reluctantly exit.

We recently read of a large HFT fund liquidate after an 11 million dollar debit.

Considering that they probably began the year with 15 to 20 million […]

Fed signals a possible return to “normal”

While the Fed raised worries with talk of raising rates in the future, should unemployment stay below 6.5%, in the long run it might be the best thing for this market to normalize.

We have had interest rates near zero for 5 years now. Flash back to 2009, March with the S&P at 666, the Dow at 6500 and a complete liquidity crisis.

60 months later, the indexes have more than doubled. 2013 saw 30% returns in the market, while the “inflation” hedge ( long commodities and gold) had a negative 30% return.

The S&P is in a nice channel upward going back to December […]