Yesterday we had a ton of activity and I am going over positions one by one. The Dow Short position was/is rewarding. Tuesday or Wednesday I wrote about Corn trading range choices. Yesterday, we took out the 13.50 level. While I had been a seller initially there, I had indicated if it moved sharply higher I suggested flipping and going w/ the break out.

Trades like that are dangerous b/c you can get just chopped to bits on a volatile market. That being said I am long August gold on this break out. Support is going to remain 1350 b/c it was good resistance for […]

Uncategorized

Gold "breaks out" above 1350– next stop 1394 to 1400?

Yesterday we had a ton of activity and I am going over positions one by one. The Dow Short position was/is rewarding. Tuesday or Wednesday I wrote about Corn trading range choices. Yesterday, we took out the 13.50 level. While I had been a seller initially there, I had indicated if it moved sharply higher I suggested flipping and going w/ the break out.

Trades like that are dangerous b/c you can get just chopped to bits on a volatile market. That being said I am long August gold on this break out. Support is going to remain 1350 b/c it was good resistance for […]

Wheat Corn Spread Narrows

Three days ago I wrote Adios Wheat/Corn spread. With the FSA acres yesterday, and WZ unable to make much headway from its contract and 14-month lows, we are at the 1/2 point of the recent trading range which saw spread bottom at 148.50 in July and rally up the the recent resistance at 2.10. Consider scale in buying at 173 to 170. Be willing to run fast though, if it takes out support at 166, and possibly even flip on the short side if that happens.

Its a […]

November Beans rally 95 cent off its 14 month low

The 14 month low at 11.62 1/2 came on August 7th. That’s 5 days ago. We have now rallied 95 1/2 cents from that low.

Upside looks like 12.75 to a re-test of the 12.93 high. This is the early frost/ its too dry/ we’re all short in the hole/ exports were good rally.

If you are a producer, I’d sell into it.

If you are a speculator, I’d stand back or sell into anything close to 12.75 with tight stops.

CER

Dow 400 Pts off its recent high

This is a daily chart of Sep Dow Futures. If you’ve been following along, I have been suggesting a short position against 15,500 for the past several weeks. We took 100 ticks of heat, and settled two days above 15,500. We never got the third day of settlement above 15,500, and because of that, although we still got stopped out of 2/3 of the original position, we are in good shape on the other 1/3. I even suggested adding to that short position on Monday when I came […]

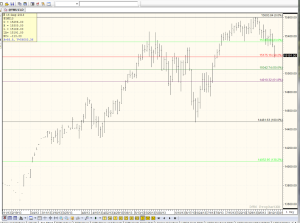

Gold Trading Range Choices

Above is a Daily Chart of August Gold. Its hovering at 1350 resistance. I’d be a scale in seller at 1342 to 1348. A settlement above 1350 and I’d flip and get long.

I’d be a buyer at 1305 to 1300. We seem to be trying to flush out a bottom here, and if you’ve been following along, I would try to be a buyer at the 1300 level, scale in buying at 1307.

Look to trade this range and then catch the break out

It looks […]

Adios for now for the WZ/CZ corn spread

If you have been following along, I had suggested buying the WZ/CZ spread at between 180 and 175. We had a good rally up to almost the 2.10 level. However, there is major resistance at that level if we look at the above chart. Going all the way back to February, for 6 months, the 2.06 to 2.09 level has been a wall of resistance. I would not want to be long this spread again until we test the 1.80 to 1.70 level once again. If the supply/demand […]

Corn and Wheat have Funds Short

The funds are net short about 120K corn contracts. They continue to be net short Chicago Wheat as well. They are still long about 75K contracts of new crop SX beans.

4.50 is where were are in CZ 6.45 in WZ. SX has bounced back here to the 12.00 level.

I’d remain short CZ. We have been net short against the 5.65 to 5.70 level for quite some time. Roll down protective buy stops and sit tight.

I continue to be short Dow Sep against the 15500 level. We only settled above 15500 3 consecutive days. I was stopped out of about 1/3 of my […]

Vacation 2013

I am taking the next 10 days off fyi.

I have protective stops working in all my positions and my hope is to not read a paper or watch TV or look at my phone for 10 days.

I did take profits on the WZ-CZ spread. bot for 180. sold for 207. Took profits on 1/2 of the position.

CER

Hedger Update: 33 month low in Corn: 14 month low in Beans

Corn: December corn settled down 12 cents at $4.67, which, if you are keeping score is a 33 month low settlement. CZ posted a 33 month low at 4.60. From the contract high of 6.65 posted 9/7/12, today’s low punctuates a $2.01 loss in value, or 30% of its value. Traders turned their noses up at what were good export numbers. Old crop sales were 134,000MT and new crop came in at 1,072,200 MT for a combined 1,226,200 […]